KUALA LUMPUR: Pay TV firm Astro Malaysia Holdings Bhd has set an indicative price range for its US$1.5 billion listing and lined up 16 cornerstone investors for what could be the country’s third-biggest initial public offering this year.

KUALA LUMPUR: Pay TV firm Astro Malaysia Holdings Bhd has set an indicative price range for its US$1.5 billion listing and lined up 16 cornerstone investors for what could be the country’s third-biggest initial public offering this year.

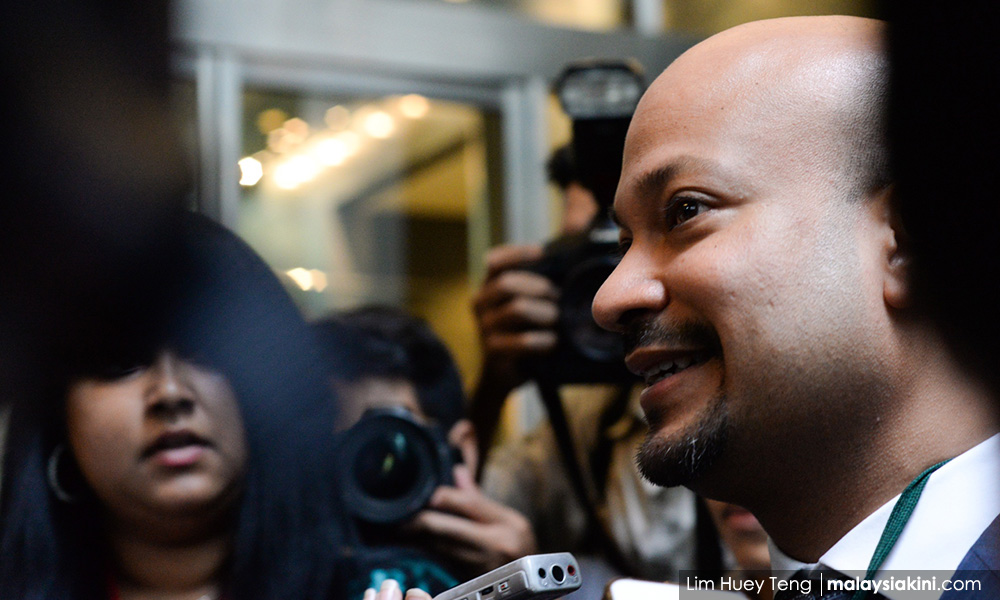

Astro, controlled by Malaysia’s second-richest man Ananda Krishnan, set an indicative price range of RM2.70-RM3 per share for institutional investors for its IPO that could raise up to RM4.56 billion (US$1.5 billion), two sources with direct knowledge of the deal said.

The institutional book for Astro will open today, said one of the sources, who declined to be identified as the deals were not yet public.

Cornerstone investors placed bids for more than 70% of the institutional shares as of last Thursday, the other source said, underscoring the growing interest in Malaysian deals and the emergence of Southeast Asian capital markets.

“They have secured 16 cornerstones,” said a third source, declining to identify the investors as they may still change their plans.

Cornerstones such as big money managers or sovereign wealth funds back many Asian listings, committing to buy large, guaranteed stakes and agreeing to a lock-up period during which they will not sell their shares.

The Astro IPO, expected to be listed by end-September or early October, would follow a US$3.3 billion share sale by Felda Global Ventures Holdings Bhd in June and IHH Healthcare Bhd’s US$2.1 billion IPO in July.

Malaysia, where the government has a heavy hand in the economy and the equity market is dominated by local investors and large domestic pension funds, has defied a gloomy trend elsewhere that saw several IPOs pulled due to a lack of investor interest.

Equity issuance in Malaysia stands at about US$7.9 billion year-to-date, compared with US$3.9 billion last year, and the shares of Malaysian IPOs this year have gained 17% on average since the companies were listed, according to Thomson Reuters publication IFR.

Astro is offering up to 1.52 billion shares in its IPO, of which 597.69 million shares will be offered to indigenous Bumiputera investors, 661.75 million to institutional investors, and the balance to retail investors.

Based on the indicative price range, the total 1.52 billion shares offered could be worth RM4.1 billion to RM4.56 billion.

Astro officials could not be immediately reached for comment today.

Ananda, who owns telecom and energy companies, is relisting Astro after it was privatised in 2010 in a deal that valued it at around US$2.8 billion.

The deal is being handled by CIMB Group Holdings Bhd, Malayan Banking Bhd and RHB Capital Bhd. Several foreign banks are also advisers, including UBS AG, Credit Suisse Group AG, Goldman Sachs Group Inc and JPMorgan Chase & Co.

– Reuters