Maybank Berhad, a government linked company, has again incurred the wrath of unionists for allegedly rejecting their leave application to prepare for a strike.

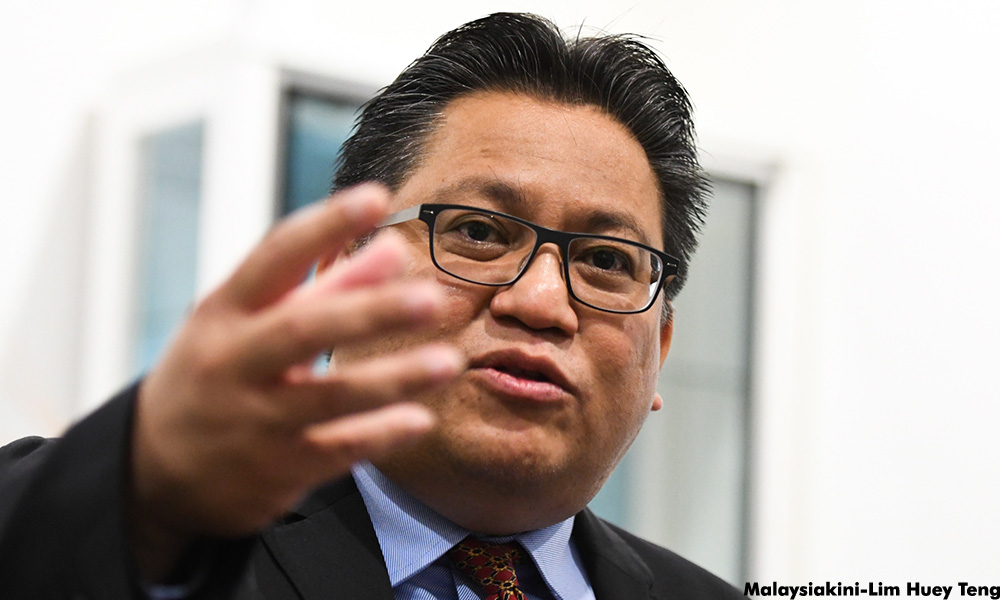

National Union of Bank Employees (Nube) general secretary J Solomon (left) has lashed out at the bank for purportedly dragging all commercial banks down their “evil act of union busting”.

National Union of Bank Employees (Nube) general secretary J Solomon (left) has lashed out at the bank for purportedly dragging all commercial banks down their “evil act of union busting”.

He claimed that yesterday, the bank had rejected 17 Nube applications for trade union leave for its executive and committee members.

He alleged that the bank had got the Malaysian Commercial Banks Association (MCBA) on board to direct all its members to deduct salaries of all Nube exco and branch committee members on trade union leave to prepare for strike action.

“In contrast, Maybank has granted approximately 36 of the inhouse union (Mayneu) individual’s trade union leave to visit all branches nation wide to campaign and coerce Nube members to exit the union and join the in-house union,” alleged Solomon in a statement.

“This is yet another violation of Section 4,5, and 6 of the Industrial ACt 1967 and Article 7 of the MCBA/Nube Collective Agreement,” he added.

Another round in ongoing war

Nube’s latest skirmish with Maybank is over two employees sacked for participating in a trade union activity in Switzerland recently.

The duo – Nube honorary treasurer Chen Ka Fatt and vice-president Abdul Jamil Jalaludeen – were dismissed on Jan 31, for holding a banner with words “Maybank robs poor Malaysian workers” outside the United Nations building in Geneva.

Yesterday, unionists held a colourful and noisy protest outside the Farquhar Street Maybank office in Penang, condemning the bank’s action.

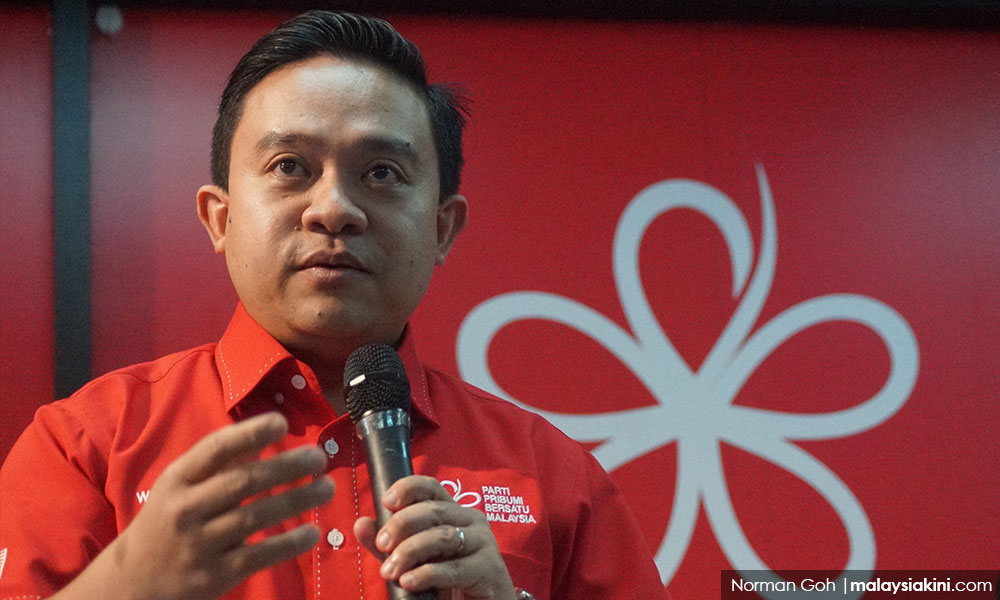

On the bank’s union busting intention, Maybank’s chief executive Abdul Wahid Omar had denied the matter, saying the company “respected” the right of employees to participate either in an in-house or industrial union.

On the bank’s union busting intention, Maybank’s chief executive Abdul Wahid Omar had denied the matter, saying the company “respected” the right of employees to participate either in an in-house or industrial union.

Solomon accused Maybank of blatantly violating the country’s laws and the current collective agreement in force and recognising the in-house union that Maybank’ s legally been stopped from doing so.

This is another attempt, he claimed, to stifle Nube’s action in protecting workers’ rights in Maybank.

“We are grateful for all the 65 members from all banks who are not deterred by the threat of salary deduction and are united to end this Maybank tyranny,” he said.

Solomon expressed surprise that the BN administration is allowing Maybank, one of its GLCs, to exploit workers by violating all the laws introduced by the same government.

“Is the BN government protecting the laws of the country for workers or allowing the GLC to break those laws?” he asked.