1MDB is turning into a serial borrower

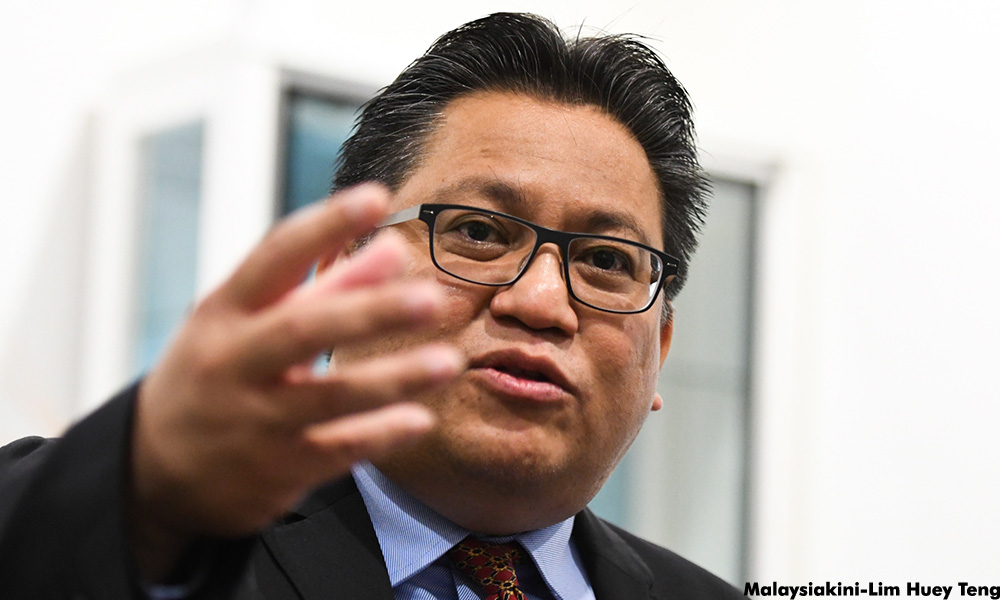

Pua: Disgraceful for 1MDB to borrow from Ananda

Fair Play: Petaling Jaya Utara MP Tony Pua, look at it this way. The PM (as chairman of the sovereign fund) is caught between a rock and a hard place.

Fair Play: Petaling Jaya Utara MP Tony Pua, look at it this way. The PM (as chairman of the sovereign fund) is caught between a rock and a hard place.

If the loan is not repaid, those banks that lend the money to 1MDB (1Malaysia Development Berhad) would be in trouble in respect of their capital ratio adequacy caused by the non-performing loan (NPL) and BNM (Bank Negara Malaysia) would be forced to take action.

This is turn might cause a severe stress on the financial and banking system which the central bank can ill-afford at the present time.

Tycoon Ananda Krishnan’s action is akin to performing ‘national service’, or more likely a quid pro quo. But would this be enough, bearing in mind the total debts amount to some RM42 billion?

More likely, this is buying them (1MDB) time for now. Just wait and see.

Louis: Tony, you are right. A sovereign fund having to borrow from an individual is truly disgraceful. Maybe it could not get loan from other banks and has to borrow from Ananda.

It is just like a struggling company which fails to get bank loan, having to resort to borrowing from ‘Ah Long’ to pay its debt.

Kim Quek: Taking huge loans at cut-throat terms in order to buy mega power assets at inflated prices from cronies, causing a mountain of debts that run into tens of billions to be built up, for which it can’t repay – what a nightmarish scenario for a so-called sovereign wealth fund.

No wonder the auditor-general and the Parliament’s Public Accounts Committee are shuffling the ball to and fro when asked to look into the scandalous affairs of 1MDB.

Abu_Maryam: YB Tony, how many times must people tell you that 1MDB is not a sovereign wealth fund? It does not even fulfil the criteria to be a sovereign wealth fund (which invests surplus money). It is a strategic development company that is government-owned.

Umnosyaitan: The recent depreciation in the ringgit against the US dollar is putting more pressure on 1MDB, given that it has an estimated US$7.4 billion in dollar-denominated debts.

As at March 2014, that amounted to RM22.048 billion but has since increased to an estimated RM25.7 billion at the current exchange rate of RM3.48 against the dollar.

It remains to be seen how 1MDB will support its ever-growing debts, but a default is certainly in nobody’s interest, which would be catastrophic – not only for the many banks that are exposed but also the country’s balance sheet and indirectly, every Malaysian’s pocket.

Silent and ominous, 1MDB has been much more than a four-letter word that has defined 2014.

It could well be the legacy Najib is remembered for, perhaps not in a way he would have hoped for, unless something quick is done to fix its fundamental problem – debt and asset heavy but lacking in cash flow.

Wg321: Can new 1MDB CEO Arul Kanda Kandasamy officially informed the Malaysian public where is the balance of RM2 billion money that was brought back from the Cayman Islands in order to pay the RM2 billion debt owing to Maybank and RHB before Jan 31?

Why must you take a loan of RM2 billion from Ananda when you already have this sum of money sitting overseas?

Put simply, 1MDB has just transferred its debt from Maybank and RHB to Ananda. The original debt is still there. But where is the RM2 billion that was supposed to be transferred back to Malaysia?

Mushiro: This is the same Ananda Krishnan who sold his soon-to-phase-out IPP (independent power producer) to 1MDB for very much above the market value.

Now 1MDB still runs to him for desperate financial help. Is there no shame, no business acumen, no ethics and no decency among the 1MDB adviser and his men? Ananda will squeeze 1MDB hard and the loan money will ultimately be paid by the people.

Boonpou: You can shout, cry, complain, and protest all you want. This government will not bother. This government is beyond being arrogance. It has the military, police, judiciary, and the EC (Election Commission) in their pockets.

In fact, they have all facets of what is to be a democratic component in a so-called democratic country in their pockets.

The only way to get rid of such arrogance, albeit really difficult, is through the state and federal elections. It’s really difficult because they have the EC, not to mention, all sorts of irregularities working in their favour.

Oh, not forgetting, the fools, which consist of so many of Malaysians that are easily sold by the politics of race and religion.

But Malaysia is not unique. Like so many post-colonial countries since the systematic dismantling of the Bandung project, we have seen the disasters of the post-independence experience and the brazen vacancy of the mimic-men who have installed themselves as captains of the post-colonial state.

Unspin: The Wharton School of Business should award an honorary doctorate to one of its alumni for inventing a brilliant business concept for people who wants to be become multimillionaires without having to do a single day of work. Here’s the rough concept:

1) Identify a greedy leader of a banana republic.

2) Ask him to sign over state assets to your firm.

3) Borrow heavily using the state assets.

4) Use the borrowed funds to acquire more assets and repeat the cycle until you are too big to fail.

5) Invest the borrowed money in hedge funds at a tax haven.

6) Pocket the commissions if the hedge fund makes money.

7) Blame someone else if the hedge fund loses money.

8) If you go bankrupt, ask the taxpayers to bail you out.

Meanwhile, all the “work” that you need to do is to throw lavish parties with Hollywood celebrities so that you can impress your business associates to invest in your ventures.

The above is a selection of comments posted by Malaysiakinisubscribers. Only paying subscribers can post comments. Over the past one year, Malaysiakinians have posted over 100,000 comments. Join the Malaysiakini community and help set the news agenda. Subscribe now.

These comments are compiled to reflect the views of Malaysiakini subscribers on matters of public interest. Malaysiakini does not intend to represent these views as fact.