Yoursay: PM, here’s the difference between FDI from China and Japan

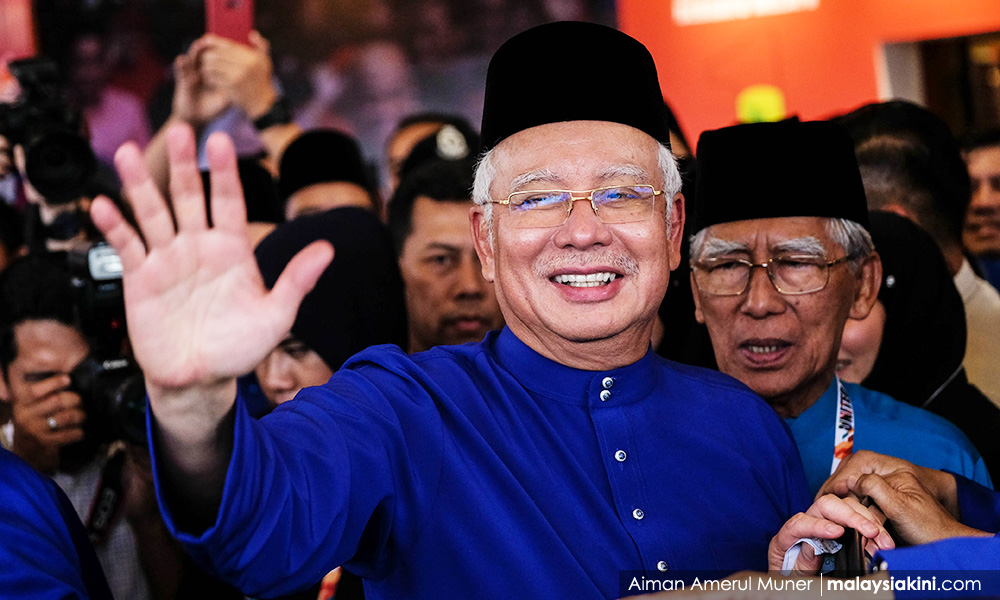

PM: Japan has more FDI here than China, but why no fuss?

Anonymous_1408265047: Foreign direct investment (FDI), which is what Japan has in Malaysia, is vastly different from foreign debt, which is largely what China has in this country. If the Chinese were investing in Malaysia, then it would be encouraging.

However, Malaysia is instead running up massive debt with China but not with Japan. If the chief financial officer (CFO) of the land does not understand the difference between the two, what hope is there for the country?

Touche: Why is it PM Najib Razak cum finance minister can’t tell the difference between Japanese FDI and China’s FDI?

The Japanese invest in industries whilst the Chinese buy or invest in land for future property development. Japanese FDI does not involve buying land for property development except for industries or factories.

Legit: Yes, the Japanese come here to invest, meaning they bring money and technology, provide employment to locals and mostly export their goods. This is called foreign direct investment. The same applies to investments from US, Europe, Singapore and other countries.

China comes here, gets the contract to build megaprojects using money they loaned to Malaysia, which Malaysia has to repay over time. They also bring in their own workers, raw materials, parts and components from China and there is minimal input from local sources.

Can someone in the PM’s Office please educate Najib on what FDI means as he doesn’t seem to get it?

Anonymous 444981488553970: Japanese companies hire local (Malaysian) consultants, contractors and suppliers.

Thus, many Malaysians benefit unlike the situation in the Malaysia-China Kuantan Industrial Park (MCKIP), whereas the Chinese government ships in their own contractors, suppliers and even materials. Hence, there is almost zero benefit for local Malaysians.

Quigonbond: The Japanese invest – meaning they take the long view and the business risk. They also transfer technology to some degree.

The Chinese lend money more than they invest. They are not taking risks. There’s a simple reason for this. They don’t trust a kleptocratic government. Big difference.

Cogito Ergo Sum: Do we need to pay back Japan any of the money they have invested in Malaysia with interest?

Whoever wrote this speech for the PM is a dope with absolutely no idea of what macroeconomics is about. But I think this kind of reasoning will appeal to those who are gullible and who are superficial thinkers.

Spinnot: Pakatan Harapan leaders hope that bashing China would win Malay votes in GE14, now that PAS is no longer with Pakatan. Bashing Japan will not win Malay votes. That’s the difference.

Besides, former PM Dr Mahathir Mohamad loves Japan. However, Mahathir’s major joint ventures with the Japanese either ended in financial failures (such as Proton and Perwaja) or in environmental disaster (Asian Rare Earth in Bukit Merah).

Fair Play: The difference is that PRC (China) did not “invest” in Malaysia. They bought over key strategic assets in the country that will amount to economic colonisation in the future.

It is indeed unfortunate that there is still confusion over the meaning of FDI, which is entirely different from foreign direct acquisition of strategic assets.

Sinan Belawan: Indeed, investments and selling off land are not the same. Investing is the process of making money over the long term, whereas selling off land is for quick money.

Moreover, the government has no right to sell public land as it belongs to the people and to future generations.

Lessons gleaned from 1MDB failings just like from past mistakes, says Najib

Anonymous 2436471476414726: There were no ‘failings’ or lapses of governance as far as the 1MDB scandal is concerned.

1MDB was formed to allegedly siphon the rakyat’s money masterminded by ‘crooks’ both within and outside the country. The money trail involving financial institutions in Singapore, Switzerland and Luxembourg clearly show the complicated scheme to allegedly steal 1MDB’s money and conceal this alleged theft.

The investigations ordered by Najib were merely to pull wool over the eyes of the rakyat. Otherwise, why would the Auditor-General’s Report on 1MDB be listed under the Official Secrets Act (OSA)?

Clever Voter: Najib now spins the 1MDB fiasco to sound as if it is some other people’s problem.

So long as there are loose ends, there will be no closure to this scandal as the PM’s involvement is not denied.

Bornean: Lesson learned: Don’t ever deposit allegedly stolen sum into your own account, especially in one of Malaysia’s banks.

Kim Quek: Najib, you are spitting out a lot of hogwash to hide allegedly the greatest theft of public funds in the history of the country, for which, you are principally and personally responsible.

Billions were lost mainly through fraud and embezzlement from this scandal, and every major financial dealing of 1MDB required your personal written approval.

The US Department of Justice (DOJ) called it the largest kleptocracy case it has handled, and described it as “the worst of its kind.”

Its culprits are being criminally pursued by more than half a dozen countries, but in Malaysia, the alleged crimes are completely swept under the carpet. No criminal has ever been pursued, not to mention arrested and convicted.

The full force of law will bear on this heinous crime when Pakatan Harapan takes over the reins of power after the next election.

The above is a selection of comments posted by Malaysiakini subscribers. Only paying subscribers can post comments. Over the past one year, Malaysiakinians have posted over 100,000 comments. Join the Malaysiakini community and help set the news agenda. Subscribe now.

These comments are compiled to reflect the views of Malaysiakini subscribers on matters of public interest. Malaysiakini does not intend to represent these views as fact.

Read more at https://www.malaysiakini.com/news/409915#77RBBv5pwWFjFTE8.99